gilti high tax exception election statement

However as a result of making. Interaction with GILTI high-tax exclusion election.

Harvard Yale Princeton Club Ppt Download

954 b 4 a so-called.

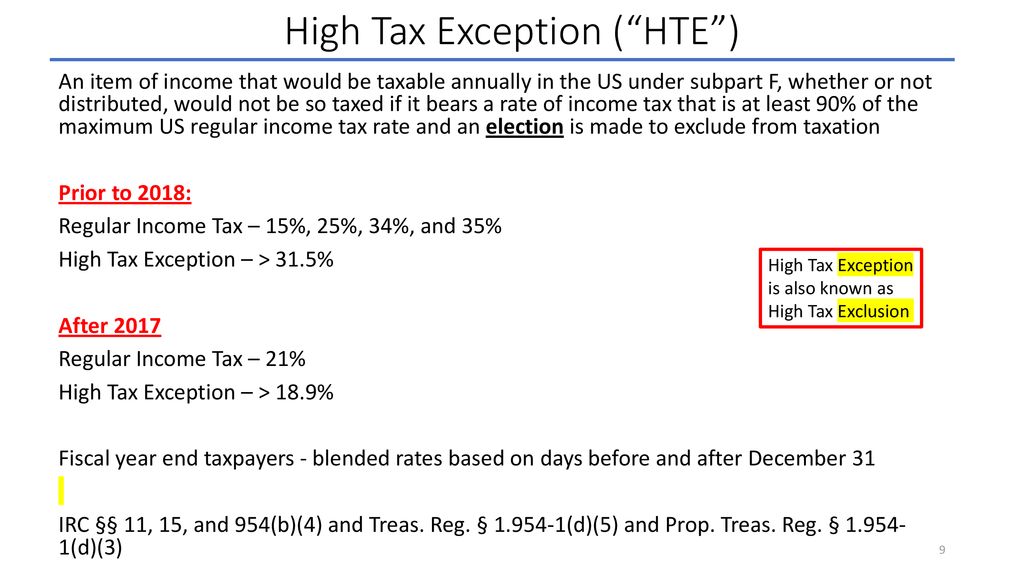

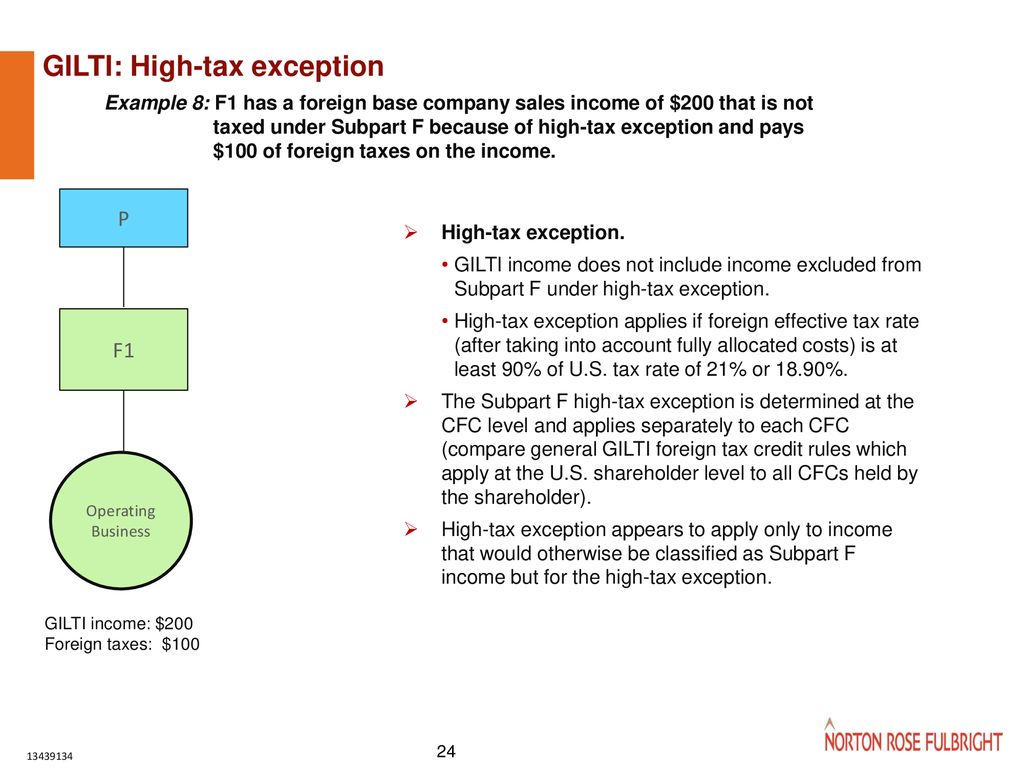

. The controlling domestic shareholder of a CFC or CFC group may claim the high-tax exclusion on an annual basis by filing an election statement. Report on Proposed Regulations Relating to a Special Preferred. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US.

Report on Proposed and Final Regulations Addressing GILTI and Subpart F High-Tax Exceptions. On July 20 2020 the IRS finalized the GILTI high foreign tax exception election regulations. The addition of a new tax on Global Intangible Low Taxed Income GILTI in the TCJA dealt taxpayers a new hand with.

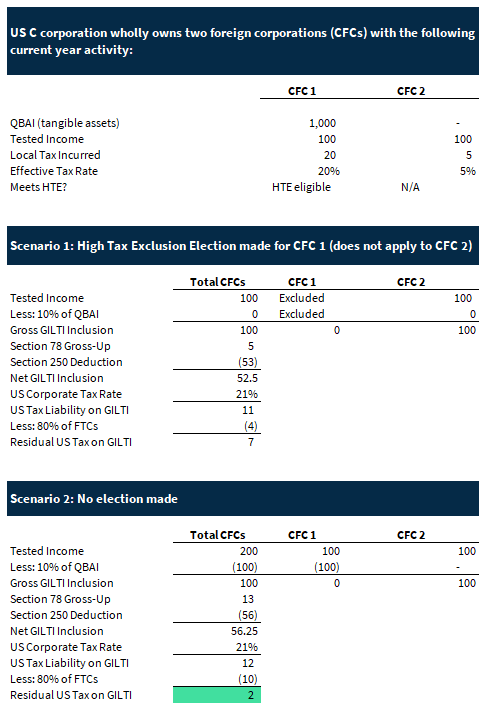

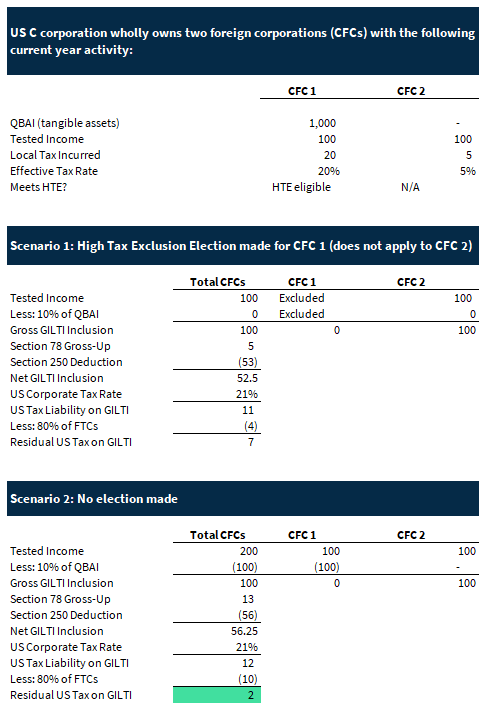

Corporate rate of 21 percent calculated based on US. Tax Section Report 1442. Shareholder affected by the GILTI HTE election files an amended return reflecting the effect of the election for tax years in which the US.

Elective GILTI Exclusion for High-Taxed GILTI. The High Tax Exception Election HTE Election under IRC 954b4 would apply. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

Applicable for tax years beginning on. Tax liability would be increased and 3 each US. GILTI and Changes to SUT Economic Nexus Threshold.

The high-tax exception in Reg. On July 23. Conformity to subpart F high-tax.

GILTI High-Tax Exception Election. David Flores Senior Manager and Expert Poker Player. 1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec.

Out effective tax rates or creating the HTE Election statement. 9902 were published in the Federal Register on July 23. Enacted in the Tax Cuts and Jobs Act TCJA 951A excludes certain types of gross income from the tested income of a CFC that a US.

Treasury Department Treasury and the Internal Revenue Service IRS released final regulations the Final Regulations on July 20 2020 regarding the global. Thus if a CFCs foreign effective tax rate is greater than 189 the US shareholder may make a high-tax election and exclude that CFCs income from GILTI. The final regulations TD.

Overview On June 24 2019 Governor Andrew Cuomo of New York signed into law SB. On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. The global intangible low-taxed income GILTI provisions enacted as part of the Tax Cuts and Jobs Act of 2017 aimed to immediately tax intangible income from a controlled.

Final GILTI High-Tax Exception. If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. Shareholder of a controlled foreign corporation CFC.

The GILTI high-tax exclusion introduced in final Treasury Regulation section 1951A-2c7 created a major new.

954 C 6 Considerations For 2021 Global Tax Management

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

Harvard Yale Princeton Club Ppt Download

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Harvard Yale Princeton Club Ppt Download

Harvard Yale Princeton Club Ppt Download

Hard Hit On Global Supply Chain Structures Ppt Download

Managing The Us Tax Impact Of Highly Taxed Foreign Subsidiaries

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

The New Gilti And Repatriation Taxes Issues For Flowthroughs

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp